The U.S. Small Business Administration (SBA) recently published a final rule on its 2019 interim final rule that adjusted monetary-based industry size standards (i.e., receipts- and assets based) for inflation which has occurred since 2014. Notably, the SBA’s recent rulemaking also included three important interim final actions.

- First, the SBA added an additional 13.65 percent inflation increase to the monetary small business size standards, which have been recently adjusted as part of the second five-year review of size standards pursuant to the Small Business Jobs Act of 2010 (Jobs Act).

- Second, the SBA adjusted three program-specific monetary size standards to account for inflation: the size standards for sales or leases of government property, the size standards for stockpile purchases, and alternative size standard based on tangible net worth and net income for the Small Business Investment Company (SBIC) program.

- Third, SBA adjusted for inflation the economic disadvantage thresholds applicable to the 8(a) Business Development and Economically Disadvantaged Women-Owned Small Business (EDWOSB) programs, and the dollar limit for combined total 8(a) contracts.

These important developments are discussed more fully below.

13.65 Percent Inflation Increase

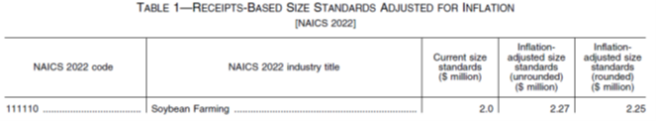

To account for inflation, the SBA has adjusted all receipts-based size standards by multiplying

their current levels by 1.1365 and rounding the results to the nearest $500,000 (except for the agricultural industries for which the results were rounded to the nearest $250,000). To illustrate the SBA’s methodology, we provide the following snapshot from the SBA’s recent rulemaking:

A complete version of the above table—which includes all NAICS codes and industry titles—can be found by clicking here.

Adjustment to Program Based Size Standards

Most SBA and other federal programs apply size standards established for industries, as defined by the North American Industry Classification System (NAICS). The SBA has also established certain size standards on a program basis, rather than on an industry basis. These include the size standards for sales or leases of government property, the size standards for stockpile purchases, and the alternative size standard based on tangible net worth and net income for the SBIC program. A table containing the SBA’s adjustments to its program-based size standards can be found here.

Adjustment of Certain Procurement Thresholds for Inflation

The SBA is also adjusting certain monetary thresholds in its regulations that are otherwise not adjusted for inflation under FAR 1.109. These thresholds primarily are those used in the 8(a) Business Development (8(a) BD) and economically disadvantaged women-owned small business (EDWOSB) programs to determine economic disadvantage. Others are used to maintain eligibility for the 8(a) BD program.

- Economic Disadvantage for 8(a) Business Development

Net worth: Under the current regulations, the net worth of an individual claiming economic

disadvantage must be less than $750,000 (13 CFR 124.104(c)(2)). Inflation, as measured by change in the GDP price index, has increased 11.86 percent since the current regulations were promulgated. The adjustment of $750,000 by that amount would translate to $838,942, rounded to $850,000.

Aggregate Gross Income (AGI): Currently, the SBA presumes that an individual is not economically disadvantaged if his or her adjusted gross income (AGI) averaged over the three preceding years exceeds $350,000 (13 CFR 124.104(c)(3)(i)). This was implemented in 2020. Inflation since then has increased 11.86 percent. The adjustment of $350,000 by that amount would translate to $391,506, which is rounded to $400,000.

Total assets: Currently, an individual is generally not considered economically disadvantaged if the fair market value of all of his or her assets (including his or her primary residence and the value of the applicant/Participant firm) exceeds $6,000,000 (13 CFR 124.104(c)(4)). This was also implemented in 2020. Inflation since then has increased 11.86 percent. The adjustment of $6,000,000 by that amount would translate to $6,711,534, which is rounded to $6,500,000.

- Economic Disadvantage Thresholds for EDWOSB Program

Net worth: To be considered economically disadvantaged, the woman’s personal net worth must be less than $750,000, excluding her ownership interest in the concern and her equity interest in her primary personal residence (13 CFR 127.203(b)(1)). The SBA implemented this threshold in 2020. Inflation since then has increased 11.86 percent. Adjusting $750,000 with that amount translates to $850,000 (rounded).

Income: When considering a woman’s personal income, if the adjusted gross yearly income averaged over the three years preceding the certification exceeds $350,000, the SBA will presume that she is not economically disadvantaged (13 CFR 127.203(c)(3)(i)). This threshold

was implemented in 2020. Inflation since then has increased 11.86 percent. Adjusting $350,000 by that amount translates to $400,000 (rounded).

Total Assets: A woman will generally not be considered economically disadvantaged if the fair market value of all her assets (including her primary residence and the value of the business

concern) exceeds $6,000,000 (13 CFR 127.203(c)(4)). This threshold was implemented in 2020. Inflation since then has increased 11.86 percent. Adjusting $6,000,000 by that amount

translates to $6,500,000 (rounded).

- Dollar Limits for Total 8(a) Contracts

8(a) BD participants (other than one owned by an Indian Tribe, ANC, NHO, or CDC) may not receive sole source 8(a) contract awards where the participant has received a combined total of competitive and sole source 8(a) contracts in excess of $100,000,000 during its participation in the 8(a) BD program (13 CFR 124.519). This threshold was implemented in 1998 and has never been adjusted for inflation. Inflation since then has increased 68.33 percent. Adjusting $100,000,000 by that amount translates to $168,500,000 (rounded).

Conclusion

The effective date of the SBA’s final rule on its 2019 interim final rule is December 19, 2022.

Comments on the SBA’s interim final provisions discussed above are due by January 17, 2023. If you have any questions about these noteworthy developments, please do not hesitate to contact Aron Beezley or Lisa Markman.